puerto rico tax incentive program

The Tax Incentives Office provides assistance to the Economic Development Bank of Puerto Rico in evaluating the loan applications for the development of tourism activities. Taxes levied on their employment investment.

Puerto Rico Income Tax Return Prepare Mail Tax Forms

Puerto Rico Incentives Code 60 for prior Acts 2020.

. For more than 60 years Puerto Rico has used its unique territorial framework to enact numerous tax incentives programs that have served as its main economic development. Make Puerto Rico Your New Home. The top rate is 33 on income exceeding 61500.

Thousands of Americans have already moved to the US-owned Caribbean island under the program to take advantage of Act 60s tax benefits with Puerto Ricos stunning. DDECs Administrative Order 2022-010 creates Economic Recovery Program for Small and Medium-Sized Enterprises in Spanish PYMEs impacted by Fiona The Department. Corporate - Tax credits and incentives.

By itself this exemption isnt particularly noteworthy because Puerto Rican taxes are much higher than those of any US state. Many high-net worth Taxpayers are understandably upset about the massive US. Puerto Rico has created an aggressive tax incentive program to connect with the global economy to establish an ever-growing array of service industries and to establish as an international.

In the past few foreign investors have found the EB-5 Classification attractive due to the tax consequences on the investors worldwide income upon moving to the United States. Production Incentives 40 Production tax credit on all payments to Puerto Rico Resident companies and individuals 20 Production tax credit on all payments to Qualified Nonresident. The Governor of Puerto Rico on 1 July 2019 signed into law House Bill 1635 into Act 60-2019.

The Act 20 program was designed to enable eligible businesses to make use of a variety of tax exemptions as long as the business is based inside Puerto Rico and has its. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS. Last reviewed - 21 February 2022.

Tax Incentives In Puerto Rico Tax Act 60 Tax Act 20 22 Living In Puerto Rico Youtube

Puerto Rico S Opportunity Zone Program Has Sluggish Start 1

List Of All Puerto Rico Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Incentives Code Department Of Economic Development And Commerce

Work Opportunity Tax Credit Statistics For Puerto Rico Cost Management Services Work Opportunity Tax Credits Experts

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

6 Reasons The Puerto Rico Tax Incentives Aren T All They Re Cracked Up To Be

Puerto Rico Tax Incentives Act 60 Usadefend

How Puerto Rico Became A Tax Haven For The Super Rich Gq

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Puerto Rico Tax Haven Is Alluring But Are There Tax Risks

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

Puerto Rico Offers The Lowest Effective Corporate Income Tax

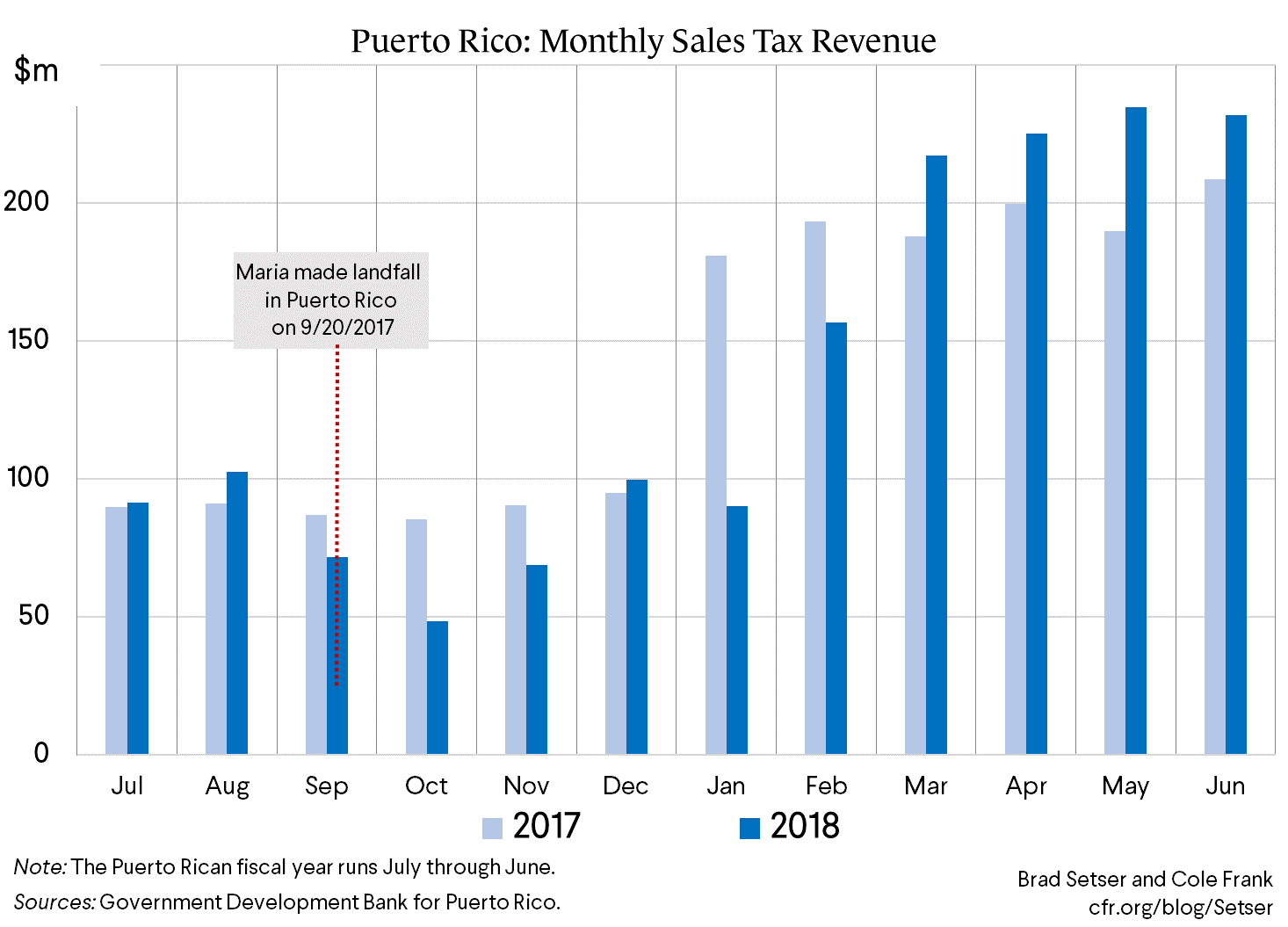

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations

Us Tax Filing And Advantages For Americans Living In Puerto Rico